Table Of Contents

Redeeming KAU and KAG

What is Physical Redemption?

Physical redemption refers to withdrawing or repaying the fixed-income securities (e.g., precious metals) stored with a financial institution or company. For Kinesis, it specifically means converting the digitalized KAU and KAG currencies back into their underlying physical bullion.

Key Highlights of Kinesis Physical Redemption

- Accessibility for Small Investors:

- Traditional market providers set high minimums for silver redemption, such as 10,000 ounces, which is impractical for many investors.

- Kinesis counters this by offering redemption options starting at just 200 ounces of silver or 100 grams of gold.

- Practical and Affordable:

- By lowering minimum requirements, Kinesis makes precious metal ownership feasible for a broader audience.

- Their low withdrawal fees further support cost-conscious investors.

Redeeming Gold or Silver from Kinesis

Kinesis offers a straightforward process for redeeming the gold and silver bullion that underpins its digital currencies, Kinesis Gold (KAU) and Kinesis Silver (KAG). Here’s what you need to know:

Eligibility for Redemption

- Right to Redemption: All holders of Kinesis currencies have the right to redeem the corresponding physical gold or silver bullion.

- Minimum Redemption Amounts:

- Silver: 200 ounces.

- Gold: 100 grams.

- Conditions: Subject to minimum withdrawal requirements and logistical arrangements.

Redemption Process

- Logistics Partners:

- Mechanics of Redemption:

- Physical bullion is delivered to the holder.

- Digital representation of the redeemed bullion is destroyed.

- The corresponding currency is removed from circulation.

Market Accessibility

- Lower Barriers to Entry:

- Unlike many providers requiring high minimum redemption amounts (e.g., PSLV’s 10,000 ounces of silver), Kinesis offers more accessible minimums.

- This inclusivity ensures that average investors can participate in precious metal ownership.

- Affordable Withdrawal Fees:

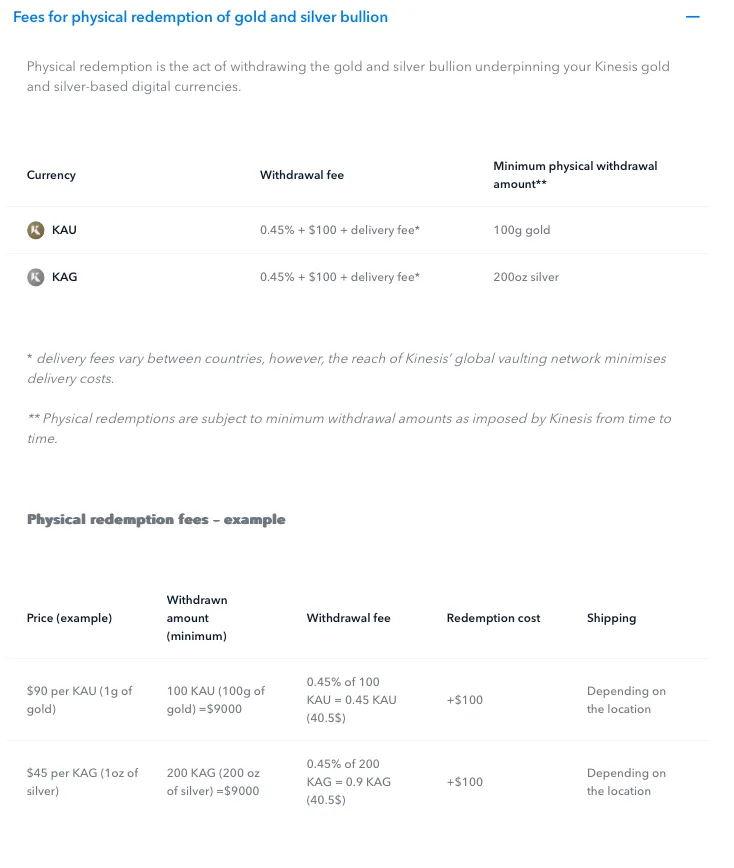

- Fee Structure: 0.45% of the redeemed amount plus a flat $100 delivery cost.

- Competitive rates make redemption cost-effective compared to industry standards.

Investor Benefits

- Transparency:

- Regular independent audits provide confidence in the 1:1 metal backing.

- Flexibility:

- Small redemption thresholds accommodate individual financial capacities.

- Security:

- Physical possession of precious metals ensures long-term wealth preservation.

- Affordability:

- Lower fees and delivery costs make Kinesis a cost-effective solution compared to competitors.

Kinesis bridges the gap between digital currency and physical bullion ownership, offering a practical, accessible, and transparent solution for securing wealth through precious metals.