Table Of Contents

Kinesis Origins And The Allocated Bullion Exchange

A Foundation of Expertise and Global Infrastructure

Kinesis was established through a strategic collaboration with the Allocated Bullion Exchange (ABX), a renowned online platform specializing in physical bullion trading. This partnership was designed to harness ABX’s experience and industry knowledge, cultivated over more than a decade of operations in the institutional precious metals market. By leveraging ABX’s expertise, Kinesis ensures the efficient, secure, and seamless management of users’ precious metal assets within its ecosystem.

ABX’s Role in Empowering Kinesis

- Decade of Expertise

- Since its founding in 2011, ABX has become a trusted name in the precious metals market, offering solutions tailored to institutional and individual investors.

- ABX’s in-depth understanding of market dynamics and global trading practices directly supports the operational and security framework of Kinesis.

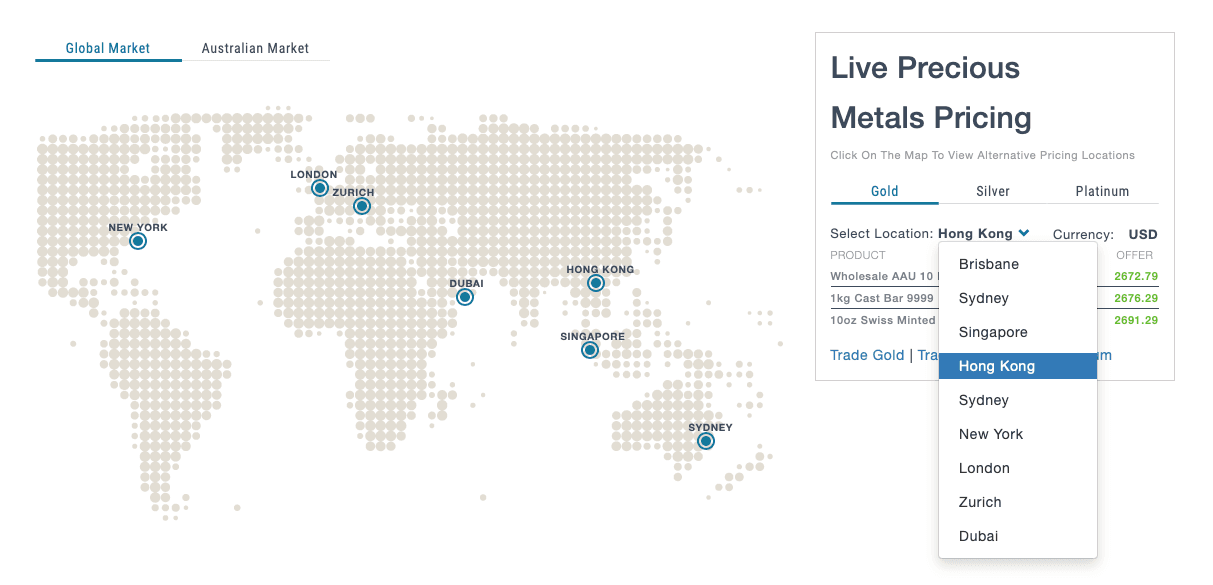

- Global Vaulting Network

- ABX has developed an extensive network of secure vaults across major financial hubs worldwide, ensuring accessibility and safety for precious metal holdings.

- Key locations include Dubai, Hong Kong, Istanbul, Vaduz, London, New York, Singapore, Sydney, Toronto, Zurich, Panama City, Batam, and Brisbane.

- This network is managed in partnership with leading global security firms such as Brinks, Loomis, and Malca Amit, guaranteeing industry-leading protection standards for all stored assets.

Benefits for Kinesis Users

- Security: Precious metals held by Kinesis users benefit from the same robust protection protocols utilized by global institutions.

- Global Accessibility: The widespread vaulting network enables users to store and access their holdings from any location worldwide.

- Trustworthy Management: Backed by ABX’s proven track record, users can trade and manage their precious metals with confidence and peace of mind.

Kinesis: Ensuring Metal Quality and Building Global Trust

All precious metals traded within the Kinesis ecosystem adhere to investment-grade standards, certified through the Quality Assurance Framework (QAF) established by ABX. This framework guarantees the provenance, integrity, and quality of Kinesis bullion, ensuring that each bar is traceable back to its original refinery. By maintaining an unbroken chain of custody and implementing stringent quality controls, Kinesis provides its users with transparency and confidence in the purity and authenticity of their holdings.

Key Features of ABX’s Quality Assurance Framework (QAF)

- Investment-Grade Certification

- Metals meet the highest purity and quality standards required for institutional and retail investors.

- Provenance Guarantee

- Every bar can be traced back to the refinery that produced it.

- Integrity Verification

- Implements checks throughout the supply chain to uphold an unbroken chain of custody.

This emphasis on quality and transparency is a cornerstone of Kinesis’ mission to foster trust among its global user base, offering them the assurance that their precious metals meet the highest standards.