Table Of Contents

- Protection against counterparty defaulting risk: ownership Title

- More than a decade of experience

- Redeeming Kinesis Gold And Silver Tokens

- Independent and regular audits Of Kinesis Gold And Silver Holdings

- Kinesis Gold & Silver blockchain Records

- Safe and fully insured storage

- Bullion quality

- Kinesis Gold and Silver Bullion

Kinesis gold & silver: allocated precious metals with electronic documentation of ownership

Kinesis gold (KAU) and Kinesis silver (KAG) are digital tokens representing ownership of physical gold and silver bullion, with each unit of digital currency equivalent to a specific quantity of physical metal. Using blockchain technology, Kinesis has put ownership of precious metals into digital form. KAU and KAG are backed by fully allocated (1:1), fully audited, fully redeemable precious metals stored in ABX insured vaults.

Protection against counterparty defaulting risk: ownership Title

The Kinesis system is set to protect holders of Kinesis currencies from the risk of dealing with a counterparty. Kinesis offers a comprehensive financial services platform that allows users to manage physical precious metals online through both a desktop platform and a mobile application. When a user purchases KAU or KAG through Kinesis, they become the sole owner of the metal, eliminating the risk of counterparty issues that may arise from bank or broker insolvency.

With Kinesis, you have complete ownership of the physical gold and silver that backs your KAU and KAG at all times. It’s important to note that each KAU (representing one gram of gold) and KAG (representing one ounce of silver) are directly backed by the corresponding quantity of physical precious metal.

The owner of Kinesis currencies has complete legal ownership of the actual amount of physical gold and silver that back the currency. The gold and silver backing Kinesis digital currencies will never be listed on the balance sheet of Kinesis or Allocated Bullion Exchange (ABX). As a result, neither Kinesis nor ABX has a direct ownership title to the metals.

More than a decade of experience

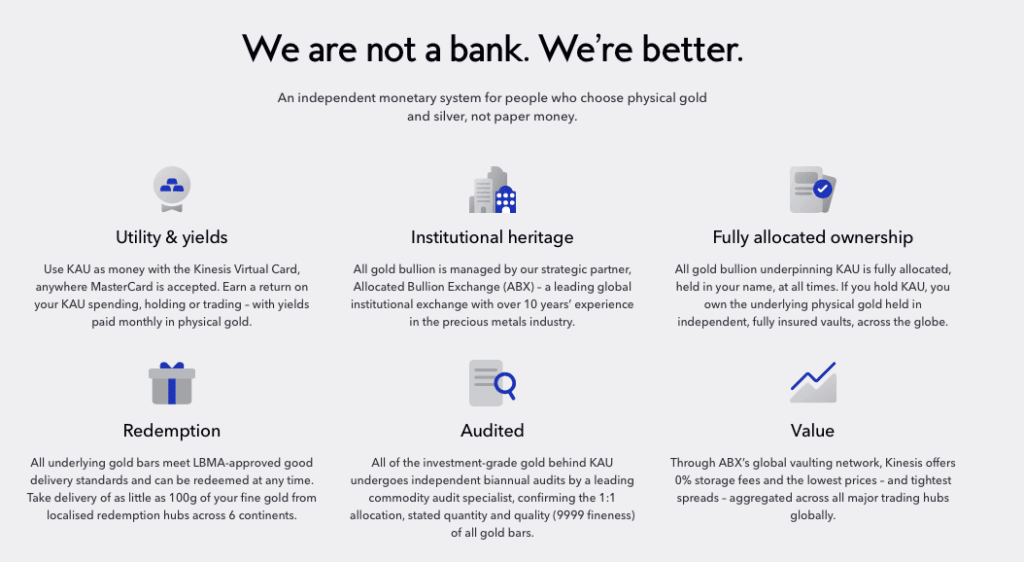

Kinesis is a partner of Allocated Bullion Exchange (ABX), a prominent institutional exchange that has been trading fully allocated precious metals globally for more than a decade. ABX is a publicly traded company and is highly respected in the precious metals industry.

Established in 2011, ABX utilizes its vast global vaulting network and expertise in precious metals trading to manage the operations of Kinesis and securely and transparently oversee all Kinesis gold and silver bullion holdings. In addition, Allocated Bullion Exchange is collaborating with the prominent clearing house European Commodity Clearing (ECC), which is part of the Deutsche Borse group. ABX ensures the highest standards of transparency, accessibility, and accountability in all the services related to trading, storing, and transporting fully allocated physical gold and silver bullion.

Kinesis leverage a network of vaulting, logistics, liquidity, and institutional-grade metals exchange services thanks to ABX. By using ABX’s vaulting network, Kinesis can provide their users with free storage for their precious metals. Furthermore, a portion of the transaction fees generated within Kinesis’ Monetary System goes towards covering the costs of vaulting.

Kinesis gold & Kinesis silver backed digital currencies are a close alternative to “home stacking” i.e. to owning & holding precious metals at home, however, having them digitally represented also allows for online management, use as currency, and easy trading, with the assurance of top-notch vaulting security.

Redeeming Kinesis Gold And Silver Tokens

You can redeem all your Kinesis gold and silver holdings. Kinesis and ABX recognise the critical need for physical redemption of any gold and silver backed currencies. To ensure peace of mind, Kinesis offers the option of physical redemption for all precious metals backing your KAU and KAG.

Kinesis currency holders have the full right to exchange their tokens for the underlying bullion that supports KAU & KAG, subject to withdrawal fees and minimum withdrawal conditions.

Kinesis allows users to exchange a minimum of 100 grams of gold or 200 ounces of silver, currently with a fee of 0.45% + $100 USD + delivery expenses. Redemption is facilitated through Kinesis logistics partners, including Loomis, Brinks, and Malca-Amit.

When KAU and KAG are redeemed vs the bullion backing them, they get removed from the amount of Kinesis currency in circulation.

Independent and regular audits Of Kinesis Gold And Silver Holdings

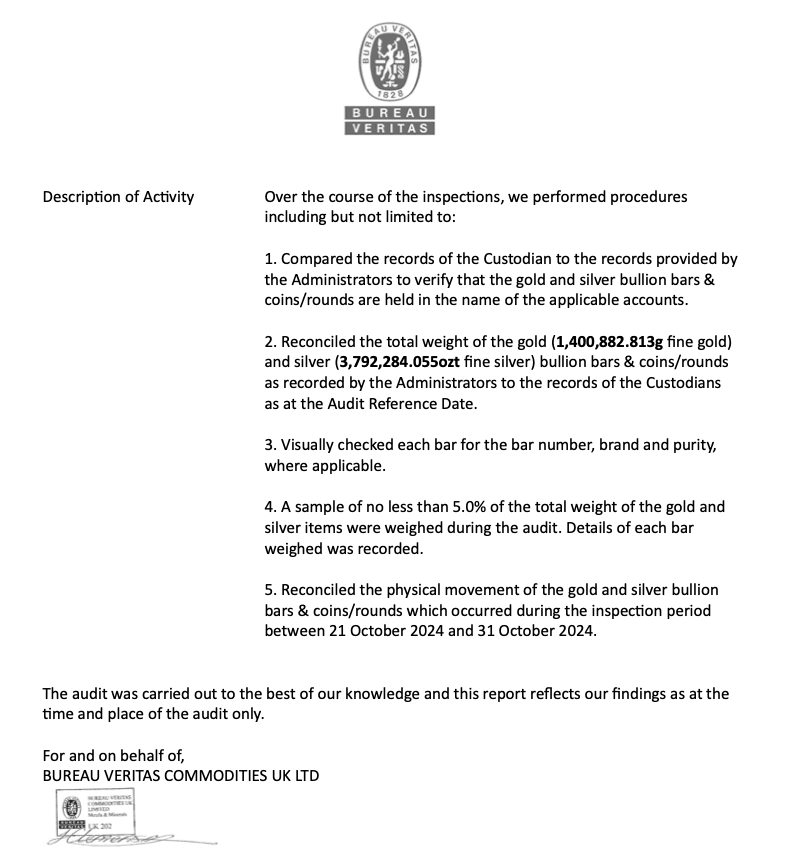

Independent audits of the metals backing Kinesis gold and silver currencies are conducted twice a year. All gold and silver bullion stored by Kinesis is subjected to independent, third-party audits twice a year.

Kinesis employs the services of Inspectorate International, an audit and inspection specialist under Bureau Veritas, in order to perform independent physical audits on all bullion underlying Kinesis digital currencies. The amount of gold and silver stored in ABX/Kinesis vaults is cross-checked with the record of all KAU and KAG in circulation according to Kinesis blockchain.

Regular independent audits have confirmed that each KAU and KAG in the Kinesis monetary system has been always backed by an exact 1:1 allocated amount of gold and silver bullion. These audits also include assessments to verify the weight and quality of the bullion, as well as the adequacy of storage facilities.

Kinesis Gold & Silver blockchain Records

Kinesis provides direct access to view all circulating KAU and KAG. Every time precious metals are added to the system, a permanent record is created on the Kinesis blockchain, keeping track of all Kinesis gold and silver within the system. This allows auditors during Kinesis biannual independent audits to verify that the amount of gold and silver held in their vaults matches the number of KAU and KAG in circulation.

Safe and fully insured storage

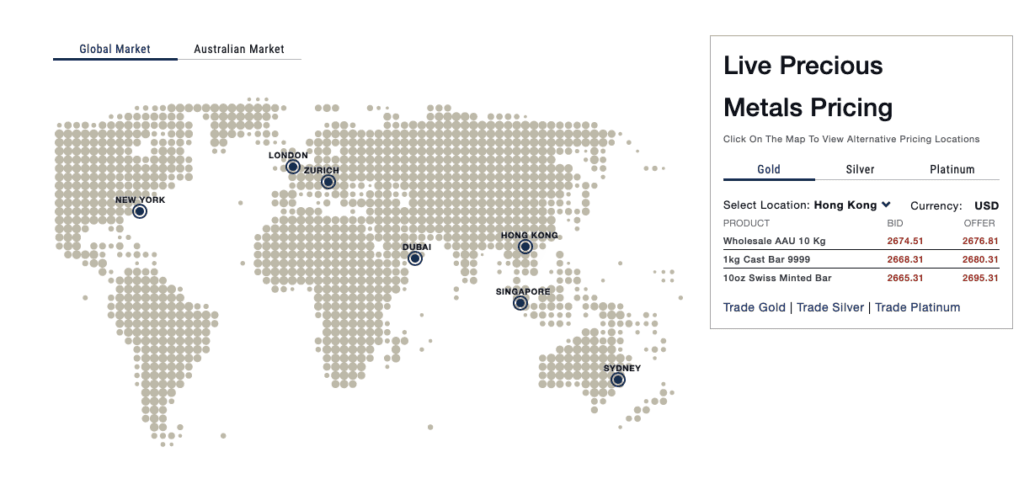

All precious metals are stored in vaults that are fully insured. Kinesis ensures that all of its precious metal holdings are fully allocated. KAU and KAG are backed by physical gold and silver bullion at a 1:1 ratio. These assets are stored in vaulting facilities in various locations including Dubai, Hong Kong, Istanbul, Vaduz, London, New York, Singapore, Sydney, Toronto, Zurich, Panama City, Batam and Brisbane.

Through ABX, Kinesis can utilize a strong global vaulting infrastructure to ensure that all precious metals are stored to the highest standards. Additionally, Kinesis has formed partnerships with well-known vaulting providers such as Loomis Zurich (Nasdaq OMX: LOOM) and Brinks (Nasdaq NYSE: BCO).

Bullion quality

All the precious metals in the Kinesis Monetary System are of high-grade quality, with a minimum purity of 9999 for gold and 999 for silver.

According to the ABX Quality Assurance Framework (QAF), all bullion is required to have a verified audit trail and be held in transparent storage systems that are regularly audited, with verification procedures in place.

- KAU, a token representing 1 gram of fine gold with a minimum purity of 9999, with serial number and identifying stamp from a refiner according to the ABX QAF.

- KAG, a token representing 1 ounce of silver bullion with a minimum purity of 999, with the identifier of a refiner according to ABX QAF standards. It may also have a serial number.

Kinesis Gold and Silver Bullion

Kinesis runs a refinery and a mint facility in Istanbul, Turkey, where they offer assaying and minting services for gold and silver bullion produced for the Kinesis Bullion store and bullion wholesalers. The state-of-the-art 5,600m² Kinesis refinery aims to reaffirm Kinesis’ position as a global leader in the precious metals industry.

The Kinesis Bullion store, run by Kinesis, offers retail investors access to reasonably priced, ethically-sourced coins and bars of high-quality for investment purposes. All coins and bars undergo laboratory testing procedures to guarantee the highest level of purity.

- Gold bullion must have a minimum fineness of 9999+

- Silver bullion must have a minimum purity of 999+